Form 1099-B: Proceeds From Broker and Barter Exchange Definition

Mar 13, 2023 By Rick Novak

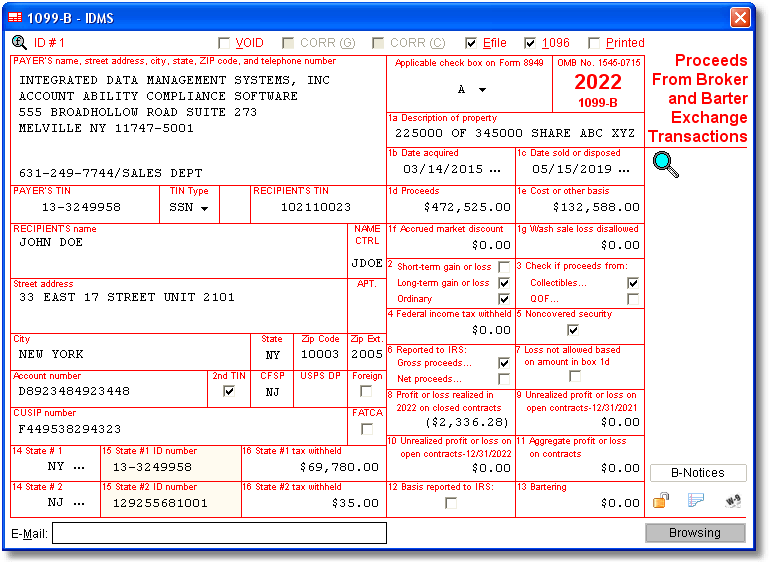

Form 1099-B details earnings from broker exchange and barter transactions. The Federal Revenue Service distributes it. As part of a person's tax return, this form will be used to declare income from assets. This includes stocks, mutual funds, and bonds. Understanding how to complete Form 1099-B is essential for taxpayers. It allows you to appropriately report their income and guarantee they comply with IRS regulations. Read on as we discuss the meaning of barter trade and respond to: "what is broker and barter exchange definition?"

Form 1099-B Basics

All barter exchanges and brokers must submit Form 1099-B to the Federal Revenue Service (IRS.) This is for each trade conducted within a calendar year. This form records the gross sales or trades, including trade-ins, that have taken place. To appropriately record their transactions and adhere to federal tax regulations, individuals and companies benefit from having a basic understanding of Form 1099-B.

Definition

A 1099-B is a form used to report income from the sale of stocks, bonds, and other investments. This form is required by the Internal Revenue Service (IRS) when taxpayers have sold these investments in the past year. Generally, it’s used to report any gains or losses that were realized on these transactions.

The 1099-B also pertains to barter exchanges involving goods or services exchanged between two parties without an exchange of money. The IRS requires each party to report their portion of the gain or loss on their taxes using Form 1099-B. A broker may be involved in some cases. If so, they must also provide a copy of this form to both parties involved. This is important in order for them to file their taxes accurately. The purpose of Form 1099-B is to ensure that all taxable income resulting from transactions is reported to the IRS.

What is the broker and barter exchange definition?

A barter exchange is an agreement between two parties to exchange goods or services without cash payments. By law, brokers who facilitate these transactions must file Form 1099-B for each transaction. This form provides information about the date, recipient, and total value of each trade conducted throughout the year. The IRS uses this data to track capital gains taxes owed on profits from any exchange activity.

Broker Exchange Transactions

Broker Exchange Transactions (BET) is the form brokers use to report property trades. The paperwork serves as insurance for the broker if the IRS queries the trade. A 1031 exchange is a "exchange of property" by the IRS. For 1031 exchanges, the BET form is necessary for this reason. Even if you did not experience any gain or loss from the trade, the form still has to be submitted.

Stocks, bonds, commodities, options, and other investments traded between two persons are included in broker exchange transactions. A straight exchange of products or services for something of equal value is a barter trade.

Barter Exchange Transactions

A barter exchange is a contract between two people or organizations to exchange products or services without using cash. Such exchanges may involve brokers, who are in charge of monitoring all transactions that take place there. Form 1099-B, Profits from Broker and Barter Exchange Transactions, lists barter exchange transactions.

The IRS defines a barter exchange as a transaction between two or more parties exchanging goods or services without any money changing hands. So, it is used in every case where goods are exchanged using a barter system. For example, a broker may also be involved in some cases where they act as an intermediary between buyers and sellers. In these instances, both parties must obtain Form 1099-B from their respective brokers to accurately report their transactions on their tax returns.

Reporting Requirements for Form 1099-B

It is required to report the sale or exchange of a security, such as stocks, commodities, and other property held for investment. The person responsible for filing this form must provide details about the barter transaction. Make sure to include the names and addresses of both parties involved in the exchange, and a description of the property exchanged and its fair market value.

Tax Implications

The tax ramifications of Form 1099-B will vary depending on a number of variables, such as the kind of security that was sold, how long it was held, and if a profit or loss was realized.

If you sold a security for a profit, capital gains tax will be due on the profit. The tax rate on long-term capital gains (assets held for more than a year) might range from 0% to 20%, depending on your income level. The ordinary income tax rate is applied to short-term capital gains, which are assets held for a year or less.

You can utilize a loss from the sale of a security to reduce additional capital gains or up to $3,000 of ordinary income. You may carry over excess losses to subsequent tax years if your capital losses are greater than your capital gains plus the $3,000 maximum on losses that can be used to offset ordinary income.

Conclusion

The Federal Revenue Service uses Form 1099-B to record earnings from broker exchange and barter transactions. It is utilized to appropriately report any taxable income arising from these transactions to the IRS and to keep track of the gross sales or exchanges, including trade-ins, that have occurred.

Also, it is utilized to keep track of capital gains taxes due on earnings from any exchange activity. Broker Exchange Transactions (BET) are used to record real estate transactions, such as 1031 exchanges. Stocks, bonds, commodities, options, and other investment forms are included.

A barter exchange is an agreement between two persons or organizations to trade goods or services for one another without exchanging money. Barter exchange transactions are listed on Form 1099-B, Profits from Broker and Barter Exchange Transactions. The sale or exchange of a security, such as stocks, commodities, or other assets held for investment, must be reported using Form 1099-B.

Together with a description of the traded item and its fair market value, it must also contain the names and addresses of both parties. Different tax consequences may apply depending on the type of security sold, how long it was held, and whether a gain or loss was achieved.

May 20, 2023 Rick Novak

Mar 27, 2023 Rick Novak

Feb 04, 2023 Rick Novak

Mar 15, 2023 Rick Novak

Mar 29, 2023 Rick Novak

Apr 03, 2023 John Davis