What is the difference between a Roth IRA and 401(k)?

Oct 14, 2023 By Susan Kelly

Deciding how to save for your financial future can be overwhelming. When weighing the options, most people think of traditional savings accounts and certificates of deposit (CDs), but another option is a retirement account known as a Roth IRA.

A Roth IRA offers many potential benefits relative to more conventional saving methods, from greater investment opportunities to tax advantages.

In this post, we’ll look at the main differences between these two options, so you can decide which one is right for you based on your financial goals and retirement plans.

What Is a Savings Account?

A savings account is a deposit account that allows you to save money while earning interest on the balance. Many savings accounts offer an annual percentage yield (APY) higher than the rate for traditional checking accounts.

When accessing your funds, most banks allow you to withdraw or transfer money from your savings with just a few clicks or a quick phone call. Savings accounts are FDIC-insured, ensuring your funds are protected up to $250,000 in case of bank failure or other unexpected events.

What Is a Roth IRA?

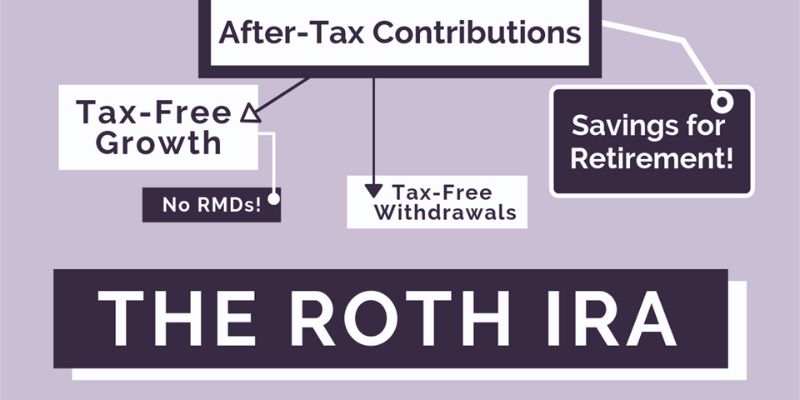

Roth IRAs are retirement savings accounts designed for Americans who want to save for their futures but don’t have access to employer-sponsored retirement plans. Unlike Savings accounts, Roth IRAs allow you to save up to $6,000 annually (or $7,000 for those 50 and older).

Contributions are made after-tax so the money can grow tax-free throughout your lifetime. The account has no expiration date, and its funds can be withdrawn without penalty.

Understanding the Differences Between a Roth IRA and a Savings Account

Roth IRAs and savings accounts provide consumers with two retirement savings options. The main differences between the two are as follows:

1. Investment Opportunities

A Roth IRA gives you more investment opportunities than a savings account, including stocks, bonds, mutual funds, and ETFs (exchange-traded funds).

This provides greater potential for growth over time compared to the more limited options available in a traditional savings account.

2. Tax Benefits

A Roth IRA offers tax advantages that can help you save more money in retirement.

Contributions to a Roth IRA are made with after-tax dollars, meaning any withdrawals taken during retirement will be tax-free – this is not the case with a traditional savings account.

3. Age Restrictions

Roth IRAs have age restrictions on when you can begin making contributions and how much you can contribute each year.

For example, if you are under 50, you can contribute up to $6,000 annually; however, if you are over 50, your contribution limit is increased to $7,000 per year. Savings accounts do not have age restrictions or annual limits on contributions.

4. Withdrawal Rules

Withdrawals from a Roth IRA come with certain rules and restrictions that must be followed to avoid penalties.

Generally speaking, withdrawals taken before age 59 ½ are subject to a 10% penalty, with some exceptions. Withdrawals from savings accounts typically do not have any restrictions or penalties attached.

How to Decide If a Roth IRA or Savings Account Is Right for You

When saving for your financial future, you have two options: a Roth IRA and a traditional savings account. Each option has advantages and disadvantages, so you'll need to consider your financial goals to decide which is right for you.

Roth IRAs are retirement accounts that offer significant tax benefits. The money put into them grows tax-free, and any withdrawals after age 59 ½ are also free from taxes. In addition, contributions can be withdrawn without penalty at any time.

However, there are contribution limits with Roth IRAs; the maximum amount you can contribute in 2021 is $6,000 for those under 50 and $7000 for those over 50. It’s important to note that this amount is adjusted every year and may change in the future.

What Roth IRAs and Savings Accounts Have in Common

Guaranteed Returns

- Both Roth IRAs and savings accounts provide some assurance of return on your investment. Savings accounts typically offer a fixed interest rate, while Roth IRAs have the potential to generate more significant returns through investments in stocks, bonds, mutual funds, and other securities.

Protection from Loss

- The FDIC (Federal Deposit Insurance Corporation) guarantees both types of accounts for up to $250,000 per account holder.

This means that if the bank fails or goes bankrupt, your invested money is still safe and accessible to you.

Tax Benefits

- Both Roth IRAs and savings accounts offer tax-related benefits. Savings accounts provide a limited amount of tax-free interest, while Roth IRAs offer the potential to have all the income generated by your investments tax-free when you reach retirement age.

Flexibility

- Both types of accounts allow easy access to your money, should you need it in an emergency or other situation.

With savings accounts, you can withdraw funds at any time without penalty; with Roth IRAs, you may withdraw funds without paying taxes or early withdrawal fees, depending on how long the account has been open and other factors.

Contributions Limits

- There are limits placed on both types of accounts regarding how much you can contribute each year. With Roth IRAs, the limit is $6,000 for those under 50 and $7,000 for those over 50; with savings accounts, there are no annual limits but only a maximum of six monthly withdrawals.

How to open a Roth IRA account

A Roth IRA account is relatively easy to set up. You can open an account at a bank, credit union, or even online with a brokerage firm.

When opening the account, you'll need to provide basic personal information and select which investments you want to make (e.g., stocks, bonds, ETFs). Once your account is established, you can start contributing to it.

Most financial institutions offer several options and fees for setting up an account, depending on the type of investments chosen and the amount of money contributed.

For example, you may be charged a commission fee each time you make a trade or an annual fee based on the size of your portfolio. It's important to review all fees before opening an account to ensure you understand the costs associated with your investments.

FAQs

Is it better to put money in savings or Roth IRA?

It depends on your financial goals and plans for retirement. A Roth IRA offers investment opportunities & tax advantages, while a savings account might be more suitable for short-term goals. Consider both options before deciding.

Do IRAs earn interest?

Yes! IRAs typically offer higher interest rates than regular savings accounts, a great way to grow your retirement funds over time. Be sure to research the best rate for you.

What is the difference between a Roth IRA and 401(k)?

A Roth IRA is an individual retirement account, while 401(k)s are employer-sponsored plans that require pre-tax contributions. They both offer tax advantages, but the rules governing them are different. Speak with your financial advisor to learn more.

Conclusion

When it comes to saving for your financial future, different options are available. Traditional savings accounts and certificates of deposit (CDs) are popular, but a Roth IRA may offer more benefits and flexibility for retirement planning. Consider which method best fits your financial goals before making a decision! It can help ensure you have the funds needed for retirement when the time comes.