What Does Dividend Per Share Tell Investors?

Jul 29, 2023 By Rick Novak

Whether you're a serious golf enthusiast or looking to take your trading game to the next level, understanding a dividend per share can be valuable.

Dividend per share (DPS) measures the financial reward an investor receives from holding shares in a company - and it's an important factor to consider when investing in stocks. This blog post'll explore how DPS works and why it should matter to any budding investor interested in golf!

What Is Dividend Per Share (DPS)?

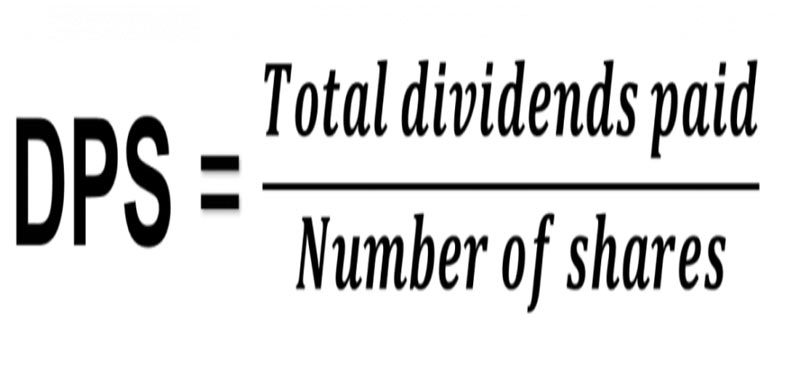

Dividend per share (DPS) measures the financial reward an investor receives from holding shares in a company. It's calculated by dividing the total dividends paid each year by the number of shares outstanding over that period. This number gives investors insight into how much they can expect to make when investing in stocks.

The amount of DPS an investor can receive depends on several factors, such as the profitability and dividend policies of the company, economic conditions, and even taxes. Profitable companies typically pay higher dividends than companies that are not. Dividend policies also affect DPS; some companies prefer to reinvest their profits instead of paying them out to shareholders, resulting in lower dividend payments for investors.

How to Calculate Dividends Per Share

When calculating dividends per share (DPS), determining the total amount paid in a given period is the first step. Add all the dividend payments issued during that time frame to do this. The next step is to divide this total by the number of shares outstanding during that same period. This will give you your DPS figure.

For example, let’s say a company pays out $10,000 in dividends over one year and has 100,000 shares outstanding at the end of that year. In this case, their dividend per share would be $0.10 ($10,000 / 100,000).

Formula

The formula for calculating dividend per share (DPS) is fairly simple. First, total up all dividends paid out during the period in question. Next, divide this number by the total number of shares outstanding over that same period. This will give you your DPS figure.

It's important to note that some companies may pay out a higher or lower percentage of their profits as dividends than others. Different types of dividends can also affect the overall DPS figure, such as ordinary cash dividends and special dividends like stock splits or spinoffs.

Dividends Per Share Interpretation

Interpreting dividends per share (DPS) can help investors make more informed buying decisions. It's important to consider the historical DPS of a company, as this can provide insight into how reliable it is for providing dividends in the future. For example, if a company has paid out consistent dividends over an extended period, chances are good that it will continue to do so. On the other hand, if a company has made drastic changes to its dividend policy or payment schedule, investors should be wary and conduct further research before investing.

In addition to providing information about past dividends, DPS can also be used as an indication of a company's financial health. If a company's DPS is significantly lower than average for its sector or industry, it could be a sign of trouble. Similarly, if the DPS is higher than expected, this could indicate that a company is doing well and that investors may benefit from holding shares in the future.

Excel Template

Investors can also use a dividend per share (DPS) Excel template to track DPS trends over time. This template allows investors to input their data for each company they track and visualize the results in an easy-to-understand chart or table. With this tool, investors can easily compare DPS figures across different companies and identify patterns that could benefit their portfolios.

Dividend Per Share Vs. Earning Per Share

Dividend per share (DPS) and earnings per share (EPS) are two important metrics used to measure a company's financial performance. While both these figures provide insights into a company's profitability, there is an important distinction between them. DPS measures the amount of money shareholders receive in dividends, while EPS measures how much profit each share generates for the company.

Investors should consider DPS and EPS when evaluating stocks to comprehensively understand a company's performance. DPS gives insight into how much income investors can expect from their investment over time, while EPS provides information about potential future growth prospects.

Generally, companies with higher dividend yields tend to be more stable and less risky, making them preferable for conservative investors. On the other hand, companies with higher EPS figures often have greater growth potential and may be more suitable for aggressive investors willing to take on more risk in search of higher returns.

What Is the Retention Ratio?

The retention ratio measures how much of a company's profits are retained instead of being paid out as dividends. It is calculated by subtracting the DPS figure from the EPS figure and dividing it by total earnings. Companies with higher retention ratios tend to retain more earnings, giving them the resources for reinvestment or expansion.

Strategies for Maximizing Your Investment with a Focus on Dividends

When investing in stocks, there are several strategies that investors can use to maximize their returns from dividend payments. One strategy is income investing, which involves selecting companies with high and consistent dividends and holding onto them long-term. This provides a steady income stream over time instead of relying solely on capital gains or short-term trading profits.

Another strategy is dividend arbitrage, where investors target stocks with higher-than-average yields and sell them shortly before the next payout date. This ensures they receive the maximum possible dividend payment without holding the stock for an extended period. Finally, investors may consider using derivatives such as options or futures contracts to generate additional income from dividends without owning any underlying assets.

FAQs

Q: How do you calculate dividends per share?

A: To calculate the dividend per share, divide the total annual dividend paid out by the number of outstanding shares. That’s it! And if you want to find out how much one shareholder would receive, multiply this figure by the number of shares they own.

Q: Why is the dividend per share important for golf investors?

A: Investing in stocks related to the golf industry can often be quite lucrative, as they offer long-term potential for capital appreciation and regular payments through dividends. As such, understanding DPS is key when making an informed decision on which stocks to invest in. A higher DPS typically signals a healthier and more profitable company that is likely to pay out larger dividends in the future.

Q: What other factors should I consider when investing in gold stocks?

A: Besides DPS, consider a few other key aspects before investing. These include the company's financial strength and stability, its future growth potential, and any risks associated with the stock. It’s also important to monitor industry developments by following news related to golf, such as tournament results and regulation changes. Considering all of these factors will help you make an informed decision about which stocks to invest in.

Conclusion

Understanding dividends per share can be a valuable asset for any investor, especially those interested in golf stocks. The key is to take the time to do your research and consider the different factors that may affect your decision. With this knowledge, you’ll be well on your way to making sound investments and earning a healthy return!

Nov 13, 2023 Kelly Walker

Mar 29, 2023 Rick Novak

Nov 14, 2023 Kelly Walker

Feb 04, 2023 Rick Novak

May 30, 2023 Kelly Walker

Aug 26, 2023 John Davis