What Is Benchmark Crude Oil?

May 15, 2023 By Kelly Walker

When people talk about oil, they most often refer to benchmark crude oil. This is the base of what makes up much of the global energy industry, and without it, our modern lives would look very different. But do you know what benchmark crude oil is?

What makes this type of oil so important for us today? In this blog post, we'll explain exactly that - from its definition and origin to where it comes from and how it's used in everyday life. Read on to learn more about one of humankind's oldest resources: benchmark crude oil.

Definition of Benchmark Crude Oil

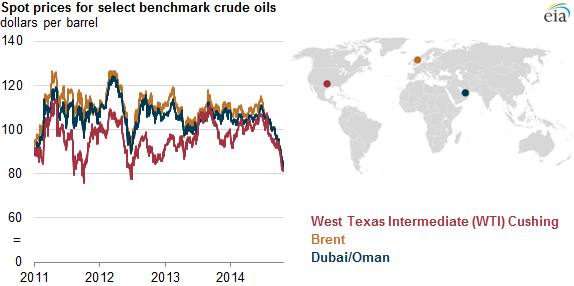

Benchmark crude oil is a reference price used to determine the value of other types of crude oil. It is set by an independent body, such as a commodity exchange or organization, and serves as a benchmark for other prices. Benchmark crude oil is usually the most actively traded type of crude oil on the market and typically influences the prices of other grades. Examples of benchmark crude oils include Brent, West Texas Intermediate (WTI), Dubai, and Oman.

Benchmark crude oil is used to create a standard for market pricing that all producers can trust and rely on when determining the current value of their product. This helps to ensure fairness in the marketplace and allows buyers and sellers to make informed decisions when trading. In addition, benchmark crude oil can provide a more accurate representation of the overall market than individual pricing data from individual producers.

Benchmark crude oil is important for buyers and sellers in the marketplace as it provides a reliable indicator of prices for everyone to use. It also helps reduce potential confusion and uncertainty in the market by providing a consistent price point. This helps to ensure that buyers and sellers can accurately assess the current value of their products and make informed decisions when trading.

History and Importance of Benchmark Crude Oil

Benchmark crude oil is a reference price used to compare the prices of different types of crude oil in global markets. It serves as a measure for determining market values and can be used to set futures contracts and other benchmarking agreements. Benchmark crude oils are typically traded on exchanges, where buyers and sellers come together to agree upon their preferred pricing terms.

Benchmark crude oils were first created in the early 1900s and have since become essential to global commerce. They are particularly important for pricing fuels, such as gasoline, diesel, and jet fuel, which are ultimately sold to consumers. By setting a benchmark for prices across different markets and regions, buyers can ensure fair negotiations with suppliers, while sellers can ensure they are getting a fair price for their products.

The selection of benchmark crude oil is also important in determining the value of oil derivatives, such as futures contracts and swaps. These financial agreements are often priced relative to the closest equivalent benchmark crude oil. Buyers and sellers can get the best possible deal by understanding which type of benchmark crude will be used in pricing.

How to benchmark crude oil is used to determine global prices

Benchmark crude oil is a type of crude oil used to determine global prices and is the standard for measuring other types of oils. The different types of benchmark crude oils are based on their composition, density, and sulfur content. Generally speaking, there are three major benchmarks: Brent Crude, WTI (West Texas Intermediate), and Dubai/Oman Crude.

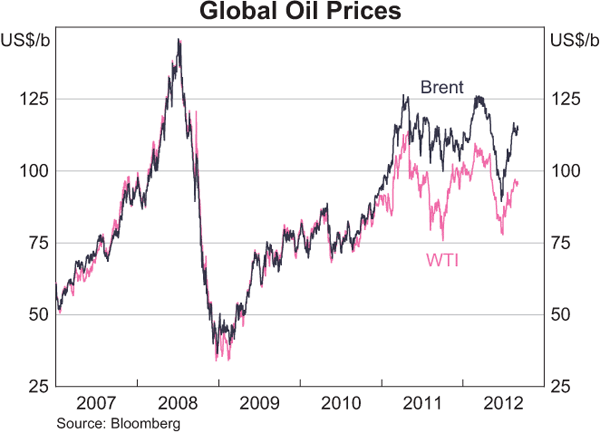

Brent Crude is a light, sweet crude oil that mostly comes from fields in the North Sea and is used to price two-thirds of the world's internationally traded oil supplies. WTI (West Texas Intermediate) is also light and sweet and comes mainly from wells in the United States. Dubai/Oman Crude is a heavier, sour crude oil from the Middle East.

The prices of benchmark crude oils are determined by trading on global commodity markets, such as the Intercontinental Exchange (ICE) and the New York Mercantile Exchange (NYMEX). These prices are then used as benchmarks to determine the prices of other types of crude oil, such as the light-sweet crude produced in the United States or heavier crude from Latin America and Africa. The global benchmark prices also serve as a reference point for further transactions and pricing decisions.

Different grades and types of benchmark crude oils

Benchmark crude oils are typically classified into two main categories: light and heavy. Light crude oils tend to produce more petroleum products such as gasoline, kerosene, and diesel fuels, with only a small portion of residual material left over at the end of the refining process.

Heavy crude oils are characterized by their lower production of these products but also result in a greater percentage of residual materials used to produce products such as asphalt and lubricating oils. The specific composition of crude oil may be classified as light or heavy or fall somewhere between these two categories.

Different grades and types of benchmark crude oils

Benchmark crude oils are the world's most actively traded commodities in different grades and types. These include West Texas Intermediate (WTI), Brent Blend, Dubai Crude, Tapis Crude, and Oman Crude. Each benchmark crude oil has its characteristics and specifications that differ in viscosity, gravity, sulfur content, and other factors.

WTI is the most prevalent benchmark among North American crude oil prices and is widely used as futures contracts' pricing reference. Brent Blend is the world's leading price marker for international oil purchases, and its price sets a marker for pricing over two-thirds of global crude supplies.

Dubai Crude is the benchmark for oil delivered to India and is considered one of the lightest, least expensive crudes in the world.

What the future holds for benchmark crude oil

Benchmark crude oil is important for understanding the energy market and future trends. As global demand for crude oil rises, new sources of supply are always being sought out. This means that benchmark crude oil prices will remain volatile shortly as supply and demand fluctuate. Understanding how these shifts affect prices can help businesses make better decisions.

At the same time, new technologies and advancements in oil production are making it easier to extract more oil from existing sources. This could help reduce volatility in benchmark crude oil prices over the long term. As demand for energy resources continues to increase, companies must stay abreast of changes in the market to ensure they remain competitive.

Changes in technology and global trends also directly impact benchmark crude oil prices. For instance, as renewable energy sources become more popular, the demand for traditional energy resources such as oil could decrease. This could lead to lower prices for benchmark crude oil over time. Similarly, changes in the political landscape could have an effect on supply and demand, which can have an impact on prices.

FAQs

What is Benchmark Crude Oil?

Benchmark crude oil refers to specific types of crude oil used as a reference price for buyers and sellers in the global crude oil markets. The main benchmark crudes are Brent Blend, West Texas Intermediate (WTI), Dubai/Oman, and African Bonny Light. These crudes are tracked daily to provide the global standard for crude oil pricing, and their prices are used as a benchmark for other types of crude oil around the world.

Who sets the price of Benchmark Crude Oil?

Various factors, including market demand, supply and production levels, geopolitics, and economic and currency fluctuations set the global benchmark crude prices. The markets also factor in supply disruptions or increased output from major oil-producing countries. Prices are ultimately determined by the interplay between buyers and sellers in the global crude oil markets.

What determines the quality of Benchmark Crude Oil?

The quality of benchmark crude oil is determined by its API gravity, a measure of its density relative to water, and sulfur content, which is expressed as a percentage. The different grades of benchmark crudes have different API gravity levels and sulfur content, making them ideal for various types of end-use applications.

Conclusion

I hope this article has helped you better understand what benchmark crude oil is and how it affects the oil industry. Benchmark crude oils are vital to helping producers, consumers, and traders make informed decisions when investing in the industry.

By having an internationally accepted standard for measuring crude oil quality, benchmark prices can be used to set fair and equitable prices, allowing everyone involved to benefit. The benchmark crude oils are also essential tools for understanding how the global oil markets work and can help make more accurate predictions about future price movements.

Apr 06, 2023 Kelly Walker

Mar 30, 2023 Kelly Walker

Jul 29, 2023 Rick Novak

Oct 16, 2023 Kelly Walker

Mar 27, 2023 Rick Novak

Apr 10, 2023 Kelly Walker