Detailed Overview of Bill of Sale

May 16, 2024 By Susan Kelly

Knowing the basics about a Bill of Sale is very important for different types of financial transactions. Its one of the most important documents in financial transactions. This article gives a complete explanation, starting from what it means to define its purpose and also explaining absolute bills versus conditional ones.

Understanding Bill of Sale

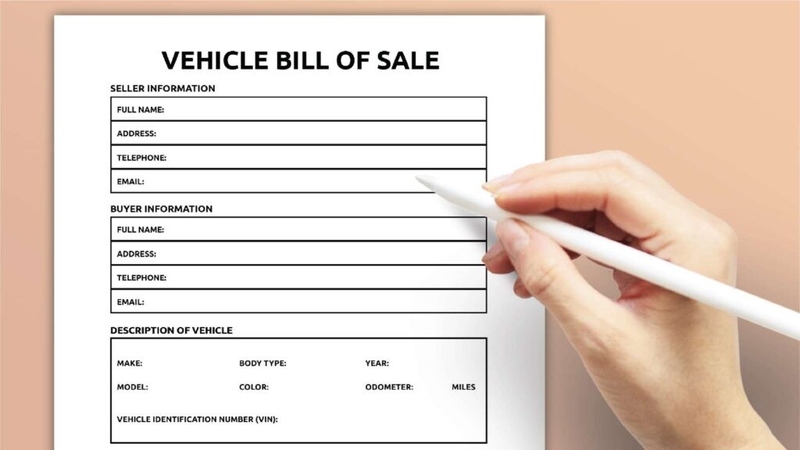

A Bill of Sale is a paper that shows the official change in ownership rights from one person, known as the seller, to another person, known as the buyer. This document holds importance in many different exchanges like selling vehicles or personal property. A Bill of Sale often includes basic information such as the names of both people involved and what was sold. It can also have extra parts to make sure each side is protected like guarantees or telling about how good an item is when it's bought (also called "disclosures"). This document acts as a safeguard, ensuring transparency and accountability throughout the transaction process.

Also, a Bill of Sale is not only for physical items; it can be used to sell non-physical assets such as intellectual property or the right to receive royalties. This flexibility makes it an applicable document across various sectors and situations, offering a legal structure for asset exchange while safeguarding all included parties' benefits.

- Consideration: Ensure the Bill of Sale accurately reflects the condition of the item being sold to avoid disputes later on.

- Caution: It's crucial to verify the identity of both parties involved to prevent fraudulent transactions and ensure legal validity.

Definition

A Bill of Sale is a document that acknowledges ownership transfer from one party to another. It works as proof for the transaction and includes important information such as item description, sale price, and warranties tied to the purchase. This paper has legal power, making it necessary for each side in an agreement to possess it. A Bill of Sale creates an official record that safeguards both buyer's and sellers' rights along with their interests involved in this exchange.

Moreover, the details found in a Bill of Sale can change based on the location and type of deal. Certain regions might demand particular legal language or clauses be present while others could allow more freedom in how it is prepared. Hence, it is important to become acquainted with applicable lawful necessities within a specific area when making or examining a Bill of Sale.

- Fact: A Bill of Sale can also serve as proof of ownership when registering vehicles or other assets with governmental authorities.

- Noteworthy: Some transactions may require additional documentation alongside the Bill of Sale, such as a lien release for vehicles or a certificate of authenticity for valuable items.

How Does It Work?

Usually, the starting point is when both sides have an agreement about what will be in the transaction. When all details are settled, then we prepare a document called Bill of Sale. This can be done by using a template or making it from nothing. After looking at what is inside and checking if everything is correct, both groups put their names on the Bill of Sale which makes it lawfully binding. For future disputes or disagreements, this written agreement will act as solid proof of what was agreed upon and make it easier to find a solution.

Additionally, although a Bill of Sale is majorly utilized for recording the sale of goods, it has the flexibility to be adjusted in various situations like passing ownership of real estate or giving up intellectual property rights. In these instances, other legal factors might become involved which will require complete documentation and review from law to verify the transaction's legality and ability to be enforced.

- Consideration: Ensure the Bill of Sale is notarized if required by local laws to enhance its legal validity.

- Not to Forget: Retain copies of the Bill of Sale for both parties' records, as it may be needed for future reference or legal proceedings.

Absolute Vs. Conditional Bills

An absolute Bill of Sale shows a complete, no-strings-attached change in ownership from the seller to the buyer. When this paper gets signed and executed, it means that the buyer becomes the full owner of an item while the seller gives up all claims or duties related to it. On the other side, a conditional Bill of Sale has certain terms or conditions attached to it before ownership can be transferred fully. These conditions may be related to the fulfillment of payment obligations or meeting specific performance requirements, offering some protection and guarantee for all sides in the agreement.

In addition, the use of conditions in a Bill of Sale gives parties the ability to customize the transaction according to their unique requirements and situations. Whether it's making certain that payment is made in parts or demanding that particular jobs be finished before ownership is transferred, bills with conditions offer flexibility and assurance which helps decrease possible disagreements or confusion later on.

- Fact: Conditional Bills of Sale are commonly used in complex transactions or situations where there is uncertainty about the completion of certain obligations.

- Noteworthy: It's essential to clearly outline the conditions in a conditional Bill of Sale to avoid ambiguity and ensure all parties understand their rights and obligations.

Conclusion

To summarize, a Bill of Sale is an important paper in money dealings that acts as a proof for changing ownership from seller to buyer. Both sides must comprehend its meaning, functioning, and disparities between absolute and conditional bills when involved in any sale process. People can protect their interests by following correct procedures and recording transactions correctly, ensuring a smooth change of ownership.